RCA direct settlement – additional option of mandatory car insurance

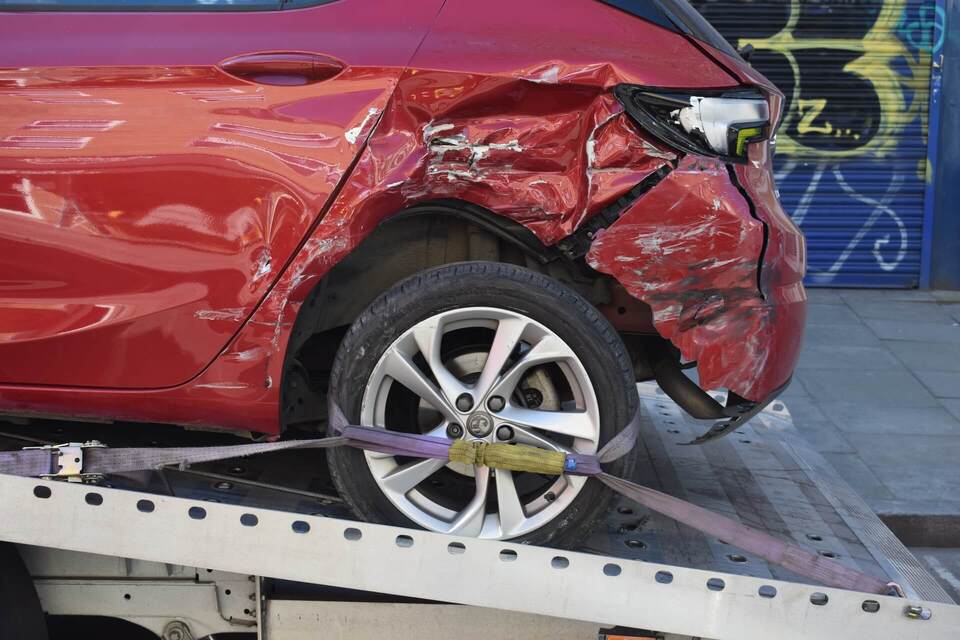

Road traffic in Romania is subject to risks, from this point of view Romania is ranked in the top places in the European Union. Traffic participants, whether individuals or legal entities, can be involved in various incidents that result in significant material damage or even human casualties. In order to manage these risks, the Romanian state has introduced the mandatory RCA type car insurance through which damages can be recovered from the company that offers this service.

Less well known is the fact that this type of compulsory insurance can be completed with an additional clause, namely that of direct settlement, a relatively new practice, which allows for the simplification of the process of recovering damages arising from a car accident through the direct involvement of the insurer the injured person.

In the article below, interested persons will be able to discover what direct settlement is as an additional option of RCA car insurance, how it works and what are its advantages and disadvantages. It will also be possible to consult the procedure that must be applied in the event of an incident on public roads in the country, both regarding the conditions that must be met, as well as the actual stages of the procedure, as well as some useful tips for choosing a reliable insurer in order to conclude the RCA policy with direct settlement.

1. What does RCA direct settlement mean?

RCA type insurance policies are tools that any car driver in Romania must have in order to ensure superior protection, in the event that damages occur as a result of a road accident. Thus, the damaged person will be able to restore his car to its original state, without spending his own money, or will even be compensated if the vehicle can no longer be used.

The process is not always easy to complete and satisfactory, because some insurance companies are not prompt enough, and a long period may pass between the event and the recovery of damages. In order to improve this process, in 2017 the option was introduced whereby a person who takes out an RCA policy with a reliable company can also request an additional direct settlement clause. Through it, the injured party can recover the damage from his own insurer, following that he obtains the necessary sums from the insurer of the person responsible for the accident.

1.1. RCA with direct settlement – how RCA insurance direct settlement works

Automobiles are significant values, both for individuals and legal entities, in many cases being essential for carrying out daily activities. Unfortunately, major investments can be lost in a single moment due to careless drivers, who cause more or less dangerous incidents while using the country’s public roads.

The mandatory RCA type insurance offers a certain protection against such events, but in order to have fast and satisfactory results every time, the specialists also recommend using the additional option, direct settlement. Normally, after a car accident, the injured party recovers the damages with the help of the RCA insurance policy of the guilty person.

However, in certain circumstances the procedure does not work correctly, the main reason being that some insurance companies are not serious. In order to avoid such unwanted situations, car owners can request the activation of the additional direct settlement clause at the time of concluding the RCA policy. Through it, the damage is removed through the financial effort of one’s own insurance company, no longer needing an interminable wait, until the other insurance company does its duty.

1.2. Direct settlement – advantages and disadvantages

Direct settlement as an additional option of RCA type insurance is recommended by specialists, because it allows people who suffer damage from road accidents to choose the desired insurer to go through the entire procedure. The option offers numerous advantages, among which can be mentioned:

- Collaboration with your own insurance company in the event of a road accident;

- Simplifying the procedure by limiting the number of documents that must be prepared;

- Efficiency of the compensation process, which ensures a quick repair;

- Obtaining access to the clause is easy, by ticking it on the regular RCA insurance (there is no need to sign a new contract);

- Offers more options dbut simple RCA insurance, being from this point of view an alternative to CASCO insurance, which is much more expensive, by the way.

It is true that this additional option involves some disadvantages. First of all, it is about the need to pay an additional tax that ranges between several dozen lei for cars and up to several hundred lei for heavy-duty vehicles. Secondly, another problem is related to the fact that the settlement does not apply in the case of accidents with vehicles that do not have RCA insurance. Thirdly, it should be mentioned that, in order to take advantage of the opportunity, it is necessary to fulfill certain conditions cumulatively.

In some cases, there was also a lack of transparency in the process, especially regarding the correct assessment of damages and settlement of repairs to the service. This last element does not seem to concern the customer directly, because he will receive his car repaired without investing money from his own pocket, but the situation can be problematic, because there can be delays regarding the settlement due to misunderstandings between the insurer and service. Now that you know what RCA with direct settlement means, you will learn more about the stages of this process.

2. Insurance with direct settlement – what is the procedure in this process?

Car owners who have RCA insurance to which the additional clause of direct settlement is added must know the procedure to be followed in order to benefit from its coverage.

If these steps are not respected, either with regard to the maximum period for announcing the incident, or the cumulative existence of the mandatory conditions, the direct settlement clause cannot be applied, following that in this case the classic RCA insurance procedure is used.

2.1. Direct settlement and the conditions that must be fulfilled

In order to directly settle the damages caused by a road accident by one’s own insurer, it is necessary to follow the procedure provided for in the Romanian state legislation and in the regulations of the insurance companies. These provisions are present to make the procedure easier, to ensure the fairness of the process and to avoid committing certain frauds.

In the unfortunate case of the need to activate the direct settlement clause, car owners must know what the conditions are stipulated in the contract to decide whether to use this option or use the classic model of the regular RCA settlement. The five conditions that must be fulfilled simultaneously are:

- The accident must have occurred on the territory of Romania;

- All vehicles involved in the accident must be registered in the country;

- Damage is only material;

- The vehicles involved must have valid RCA insurance;

- Following the accident, the participating persons must not have suffered bodily injuries.

If all these conditions are met, it is possible to apply a quick procedure to repair the car, without unjustified delays and without involving any payment on the part of the damaged person.

2.2. Direct settlement insurance – the stages of the RCA

direct settlement process

If drivers are involved in an accident that happened due to the fault of another traffic participant, the following steps must be taken:

- Ensuring that those conditions are fulfilled simultaneously that allow the activation of the clause;

- Notifying your own insurer no later than five working days after the accident;

- Forwarding to the insurer all the documents establishing the accident (amicable finding or minutes drawn up by the Police).

After completing these initial steps, the insurer will detail other measures that must be taken in order to remove the material consequences of the accident. Thus, an assessment of the damages will be made, a service will be chosen from among those agreed by the company, where all the repairs will be carried out, and the payment will be made by the own insurer.

In order to facilitate the procedure, insurance companies provide clients with a consulting service, which provides all the necessary information for a satisfactory experience. Specialists recommend that, at any moment when there is a certain misunderstanding, RCA policy holders should call with confidence, because in this way they will have the guarantee that the whole process will be correct, without problems.

The necessary documents for the direct settlement, which must be presented ensure torus are:

- the amicable declaration of the accident or the minutes drawn up by the research and control bodies;

- copy of RCA insurance policies of both parties involved in the accident;

- children according to the identity documents of the drivers involved;

- copy of the vehicle registration certificate;

- the record of damage assessment;

- repair estimate if a service agreed by the owner is chosen.

3. Tips for choosing the RCA insurer with direct settlement

Car owners who wonder if they deserve a car insurance with direct settlement should know that this element can significantly ease the process of recovering material damages caused by a car accident. Direct insurance settlement, although not mandatory, is a clause of the RCA insurances that offer real benefits that far exceed the additional costs involved for the purchase of the option. The decision to choose a RCA with direct settlement versus CASCO insurance must be made after weighing the advantages and disadvantages in order to make an informed choice.

In this sense, the main elements that are taken into account are those related to the investment that needs to be made (smaller in the case of the RCA option with direct settlement and higher in the case of CASCO insurance) and related to the degree of coverage (RCA insurance covers the damages caused by the fault of other traffic participants, while CASCO insurance can also be applied when the damage is caused by one’s own fault.

The insurance market in Romania is a dynamic one and subject to the emergence of some problems, some insurance companies tending to delay payments or to use all kinds of tricks to not exactly comply with the provisions of the contract. Because of the major risks and significant investments, clients must inform themselves in order to choose that company that will provide them with an excellent quality-price ratio. In this sense, some tips from specialists are useful, which significantly increase the chances of solving such an incident in a satisfactory way:

- Comparing the offers of insurers is useful in order to understand the costs involved, the conditions and existing coverages;

- It is important to check the financial stability of the insurer. Stable companies will be able to respect their obligations and make their payments completely and on time;

- To establish the reputation of the insurer, it is advisable to consult customer reviews in order to understand their positive or negative experiences in similar cases;

- The degree of insurance coverage is not the same for all companies that offer RCA insurance policies with direct settlement. Some companies, in an attempt to attract customers, offer certain additional options, such as for example road assistance;

- Certain companies prefer to settle the repairs made in partner services. It is advisable to consult their list to see if there are such units nearby and if they offer superior quality services;

- The compensation procedure can be quite cumbersome and, therefore, it is recommended that the choice be made with that company that guarantees a simple process in terms of the number of documents required and the method of carrying out the assessment of damages;

- Many of the companies offer certain promotions and discounts, which can significantly reduce the price of the insurance policy. This is not only about the positive or negative vouchers stipulated in the insurance legislation, but also about other elements that could attract customers.

In conclusion, car drivers in Romania who take out a mandatory RCA type policy have the opportunity to take advantage of additional benefits by using the direct settlement clause, an element that significantly eases the process of repairing cars after being involved in a road accident.

Photo sources: unsplash.com